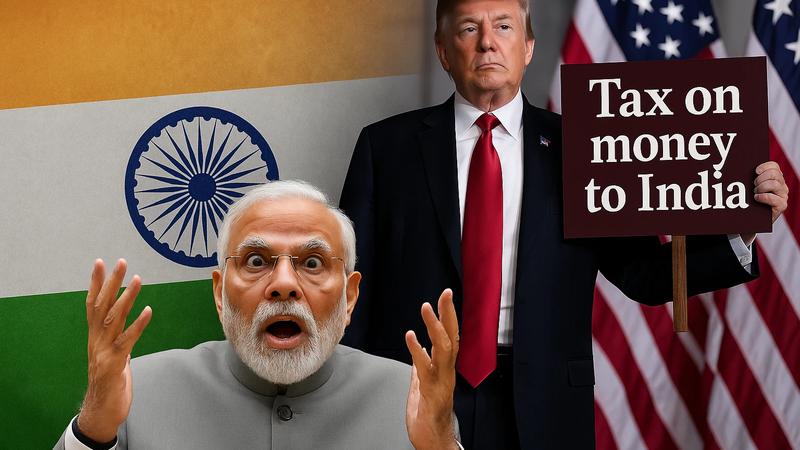

INDIANS IN PANIC MODE over Trump's Tax on money sent back to India

A recent proposal by former U.S. President Donald Trump has sent shockwaves through the Indian diaspora in the United States. The "One Big Beautiful Bill Act" aims to impose a 5% tax on all remittances sent abroad by non-U.S. citizens, including H-1B visa holders, green card holders, and international students. This move could significantly impact the Indian community, which remitted approximately $32 billion to India in 2023-24, potentially resulting in an additional $1.6 billion in taxes annually .

Key Provisions of the Proposed Bill

- Tax Scope: A 5% excise tax on all international money transfers made by non-U.S. citizens, with no minimum threshold, meaning even small transfers would be taxed .

- Exemptions: Only "verified U.S. senders" (U.S. citizens or nationals) are exempt from this tax.

- Implementation: The tax would be collected at the point of transfer by authorized remittance providers and remitted to the U.S. Treasury quarterly.

Impact on the Indian Diaspora

- Financial Burden: For every $1,000 sent to India, an additional $50 would be paid in taxes. Over time, these costs could add up significantly, affecting the financial well-being of many families who rely on remittances for their daily expenses, education, and healthcare.

- Investment Decisions: The increased cost of remittances may deter NRIs from investing in Indian real estate and other sectors, as the additional tax burden reduces the funds available for such investments .

Broader Economic Implications

- India's Economy: Remittances are a significant source of foreign exchange for India. A decline in remittance inflows could strain the country's foreign exchange reserves and impact sectors reliant on these funds .

- Global Remittance Flows: The proposed tax could lead to a 10-15% drop in remittance flows to India, resulting in a loss of $12-18 billion annually .

Community Response

The Indian community in the U.S. has expressed concern over the proposed tax, fearing it would place an undue financial burden on those supporting families back home. Many are considering accelerating their remittances before the potential implementation date of January 1, 2026 .

Conclusion

The proposed 5% remittance tax under the "One Big Beautiful Bill Act" has raised significant concerns among the Indian diaspora and could have far-reaching economic implications for both individuals and India's economy. As the bill progresses through the legislative process, its potential impact continues to be a topic of intense discussion and scrutiny.